Qatari emir vows $15bn investment in Turkey after Erdogan meeting

Erdogan (R) and Sheikh Tamim held talks for three hours [Presidential Press Service via AP

Erdogan (R) and Sheikh Tamim held talks for three hours [Presidential Press Service via AP]

Qatar pledges to make direct investment in Turkey, currently hit by currency crisis amid a diplomatic stand-off with US.

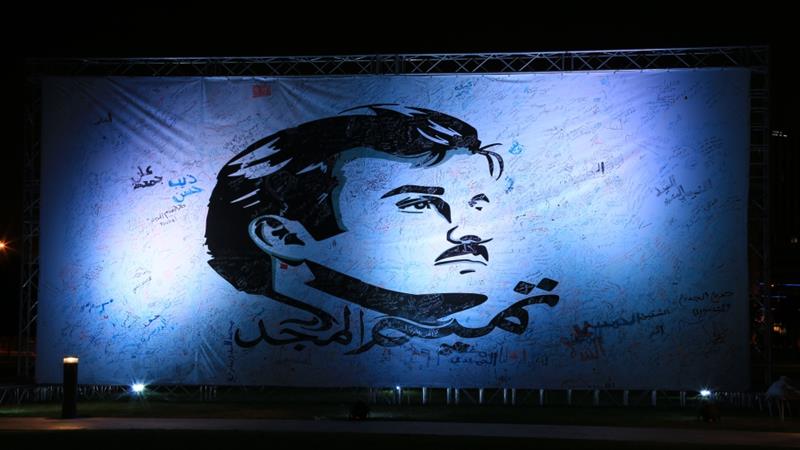

Sheikh Tamim bin Hamad Al Thani, the emir of Qatar, has pledged to invest $15bn in Turkey, according to officials.

The announcement on Wednesday came after the emir held talks with Turkish President Recep Tayyip Erdogan in Ankara, Turkey’s capital.

Turkey is currently grappling with a currency crisis and heightened tensions with the United States, its NATO ally.

Sheikh Tamim is the first foreign head of state to visit Turkey since the stand-off between Ankara and Washington started last week.

“We attach importance to his visit. This visit, at the same time, is an indicator that Qatar stands with Turkey,” Ibrahim Kalin, a spokesperson for the Turkish president, told reporters at a press conference on Wednesday.

Qatar has pledged $15 billion of direct investments in Turkey.

Turkish-Qatari relations are based on solid foundations of true friendship and solidarity.

Salim bin Mubarak Al Shafi, Qatar’s ambassador to Turkey, said his country would continue to support Turkey, adding that the emir’s visit demonstrated the “depth” of the two countries’ relations.

“Qatar will continue to stand by its Turkish brothers as it did during the failed coup attempt in 2016,” Al Shafi said, adding Qatari people purchased millions of Turkish lira to support Ankara against the “economic operation”, the country is witnessing, local media reported.

Strategic partners

Erdogan and Sheikh Tamim also exchanged views on bilateral relations and regional developments during their three-hour meeting, according to Anadolu Agency.

Qatar and Turkey are bound by strategic relations at the political, economic and military fronts.

But the Gulf country also shares a strategic partnership with the US, hosting a military base that serves as one of Washington’s most important overseas military bases with operations throughout the Middle East.

Qatar offers Turkey an investment package worth $15 billion to support the Turkish economy, during the visit of HH The Emir. It includes both new investments & deposits.

The stability and prosperity of our ally #Turkey is vital for the whole region. ???? pic.twitter.com/jjICYk2pqT

Turkey is currently in the middle of a severe financial crisis with the collapse of its currency in recent days. The Turkish lira has lost more than 45 percent of its value since 2017.

The crisis came days after US President Donald Trump announced via Twitter a doubling of steel and aluminium tariffs on Turkey, as Washington pushes Ankara to release Evangelical Christian pastor Andrew Brunson, who is being held on terrorism charges for nearly two years.

On Wednesday, Turkey doubled tariffs on some imports from the US – such as passenger cars, alcohol and tobacco – in what it said was retaliation for “deliberate attacks” on its economy.

Trade Minister Ruhsar Pekcan said the tariffs would amount to $533m.

Turkish officials have also emphasised that Ankara wants to retain strong ties with Europe, which has also expressed deep unease with Trump’s trade policies.

“The US is our major trade partner but it’s not the only one,” Pekcan was quoted as saying by the official Anadolu news agency. “We have other partnerships and alternative markets.”

Earlier on Wednesday, Erdogan spoke on the phone with German Chancellor Angela Merkel, the Turkish presidency. He is due to speak with French President Emmanuel Macron on Thursday.

On Monday, the Turkish currency hit a record low of 7.24 against the US dollar in Asia Pacific trading.

But on Wednesday the lira was trading at 6.0 to the dollar, a gain in value on the day of 5.2 percent.

According to local reports, it was boosted after the Turkish banking regulator cut the amount of funds banks can use for currency swap trading, limiting the possibilities for speculating against the lira.

Tim Ash, an analyst from Bluebay Asset Management, wrote in a client note: “Remarkable turnaround. They are killing offshore lira liquidity to stop foreigners shorting the lira.”

Qatar: Beyond the Blockade

SOURCE: AL JAZEERA AND NEWS AGENCIES